Case Studies & Sample Documents

Case Study 1 - Social Welfare Payments Only

Situation

John is a lone parent and in 2021 was on a social welfare payment for the entire year. He has 2 kids and received €277 each week.

Documents Required

John is required to provide a social welfare statement covering all of the payments he received in 2021. This can be ordered from the following link welfare.ie . John needs to specify in his request that it is only for 2021. When the statement arrives John should check that it approximately records what a full year payment would be (€277 x 52 weeks = €14,404). A sample social welfare statement is contained on this webpage also.

Case Study 2 - PAYE Paid Income Only

Situation

Mary is married and was the sole income earner in her family for 2021. Her husband is a home carer for their children and did not earn any income or receive any social welfare payments in 2021.

Documents Required

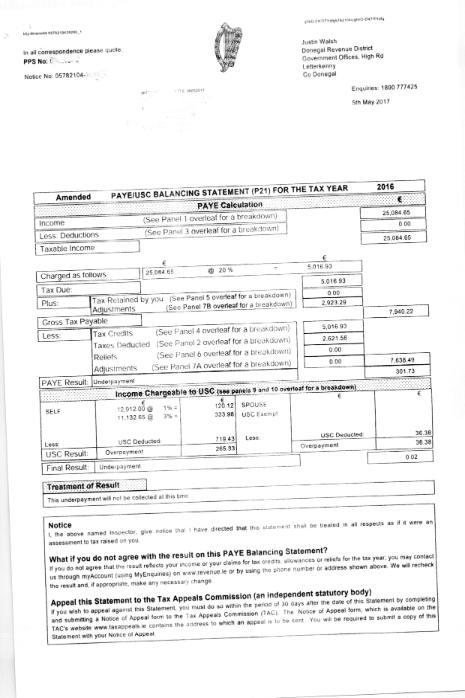

Mary is required to request a Statement of Liability ( formally a P21 - Balancing Statement) for 2021 by either ringing up Revenue or accessing the PAYE online MyAccount, facility if she is registered for this. By phoning Revenue, it normally takes a week or two for the P21 to arrive in the post but the online facility normally only takes a couple of days for the P21 to be available on-line. Mary needs to ensure that she requests the P21 for 2021 and that when she submits a copy she includes both pages of the document.

Case Study 3 - PAYE Income and Social Welfare

Situation

Paul is undertaking an eligible course in UCC for 2022/23. He is married to Tina. Both of their incomes/payments are required as this constitutes the relevant household income. Paul was employed for all of 2021. Tina received social welfare payments for all of 2021. Tina received the Pandemic Unemployment Payment for 5 months of 2021 and then received Jobseekers Allowance for the other 7 months. They are jointly assessed for income purposes.

Documents Required

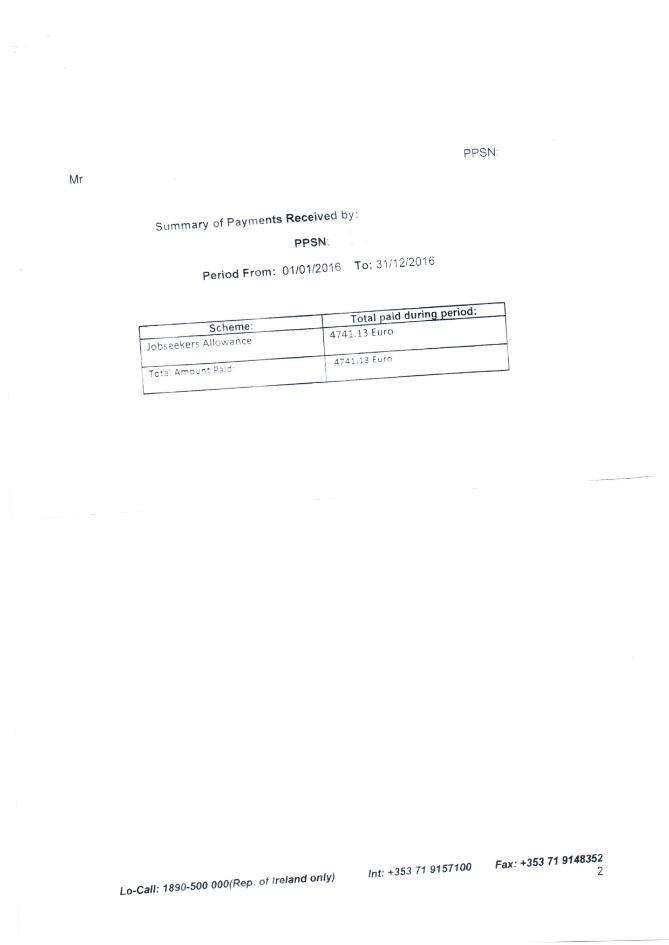

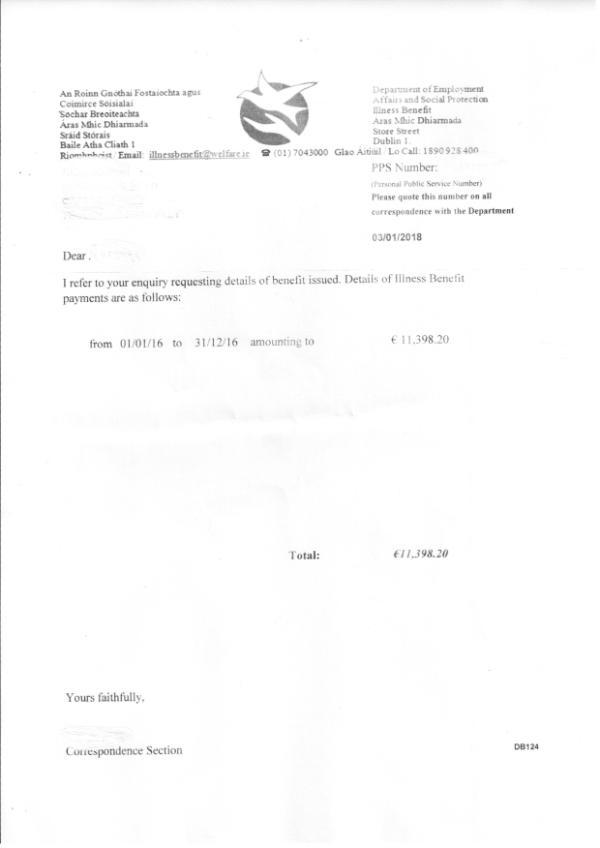

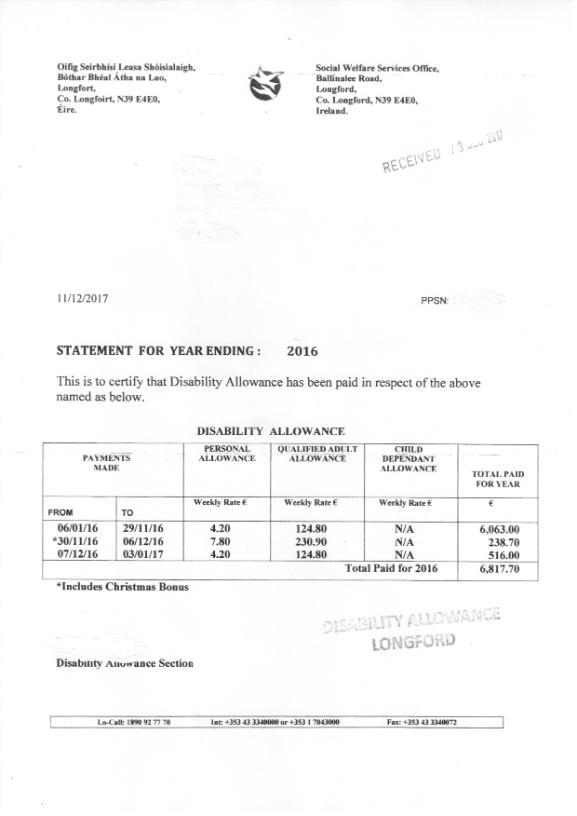

Paul needs to request a Statement of Liability formally a P21 - Balancing statement for 2019 and Tina needs to request a Social Welfare Statement for the payments she received in 2021 and needs to ensure it includes both payment types she recieved.

When Paul receives his Statement of Liability, he notices that there is a social welfare amount on it for Tina as they are jointly assessed for tax purposes. However he still needs to provide a seperate social welfare statement for Tina as firstly Revenue only record taxable social welfare payments (e.g. Jobseekers Benefit) but it does not record non-taxable welfare payments and also the amounts shown on Statement of Liability do not always match what the individual actually received.

Case Study 4 - VTOS / ETB Payments

Situation

Luke undertook a PLC course in 2021 from Jan to May with his local ETB centre. He then was on social welfare payments for the rest of the year.

Documents Required

Luke needs to request a letter from his local PLC/ETB centre to outline all of the payments he received from them for Jan to May 2021. He also then needs to request a social welfare statement from Dept. of Social Protection to show the payments he received for the rest of 2021.

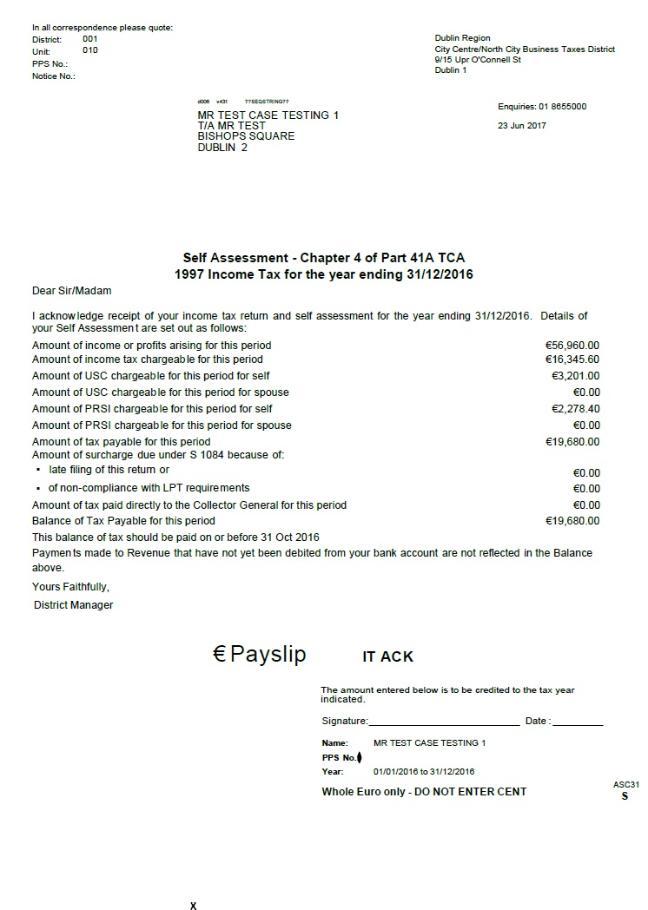

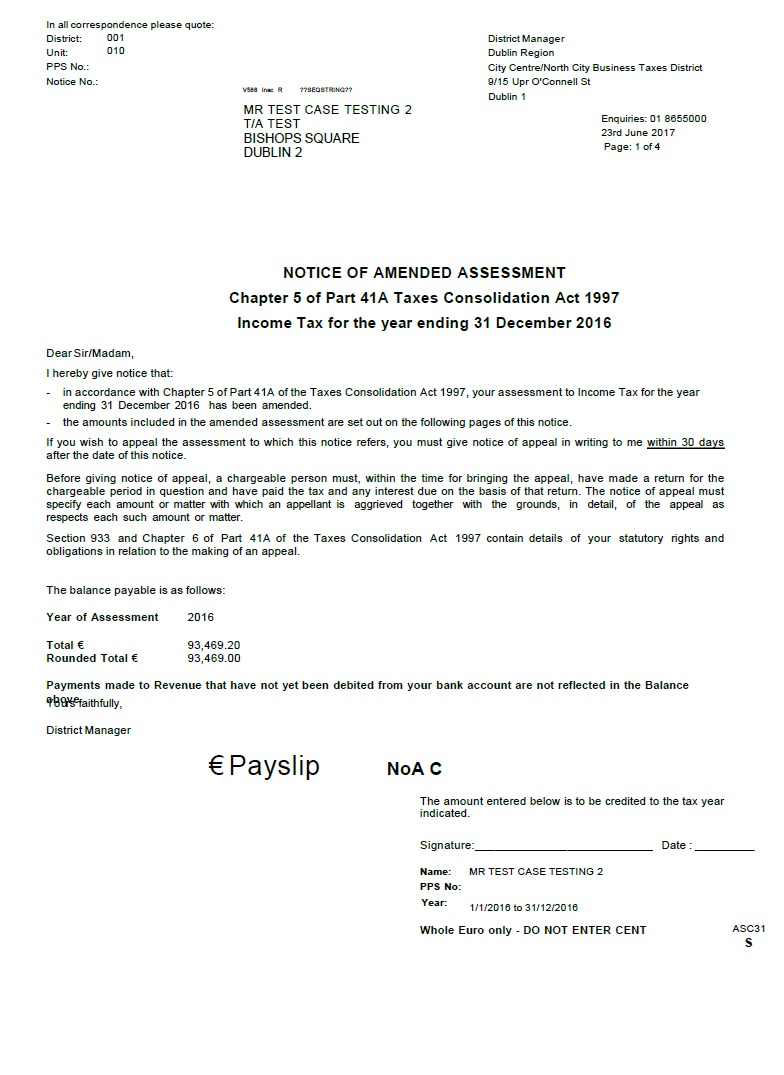

Case Study 5 - Self Employed / Farming Income

Situation

Maura was self-employed for all of 2019. She is married to David who worked for a company for all of 2019. They are seperately assessed for tax purposes.

Documents Required

Maura needs to provide a Notice of Assessment / Self-Assessment Letter - Chapter 4 or 5 from Revenue for 2019. This also needs to be backed up by a the online form 11A or paper Form 11 that was filled in when submitting the return. As they are seperately assessed, David needs to provide a Satement of Liability, forally a P21 for 2019 also as this is the relevant household income required

Case Study 6 - CE/TUS/RSS Schemes

Situation

Una was on a CE Community Scheme for all of 2021. She is a single adult with no dependents.

Documents Required

CE Schemes (along with TUS & RSS Schemes) are considered to be taxable employment and Una needs to request a Statement of Liability formally known as a P21 for 2021. These payments are not handled by Social Welfare. A letter from the CE provider is not sufficient either.

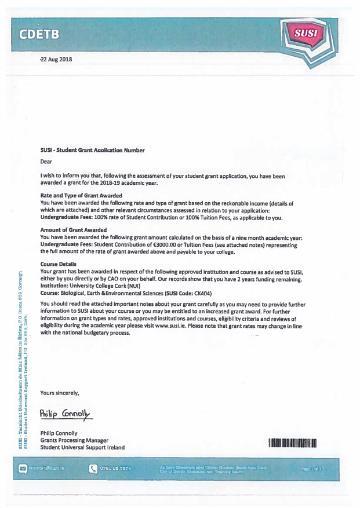

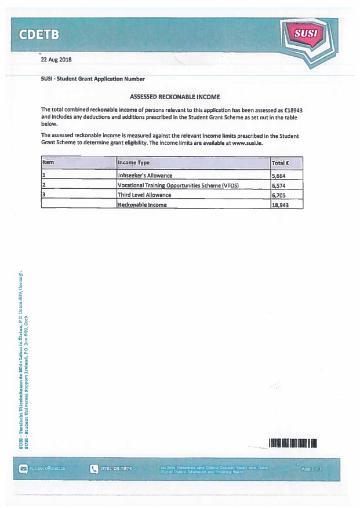

Case Study 7 - Incoming 1st Year Student

Situation

John, 18, is a first year undergraduate student who has been assessed under his parents income for the purposes of SUSI. He was awarded the grant from SUSI and this was outlined in a letter he received that gave a full breakdown of the family income.

Documents Required

All that John needs to be provide is a complete copy of all of the pages (1-3) of his SUSI award of letter that outlines the household income in 2021. Emails or screen shots are not acceptable and the letter must be for the financial year 2021 only.

Change of Circumstance and Complex Situations

If you or your household have had a major change of financial circumstance in 2022 compared to 2021, you are strongly advised to contact the office and make an appointment so we can discuss your individual circumstances. This is to ensure you are advised as to the necessary documentation you require. The same applies if you have a complex situation such as you worked or travelled abroad in 2021 or have difficulty obtaining the required documentaiton.