Can Ireland lead the offshore renewable energy race? 16 May 2023

Analysis: despite our significant geographical advantages, there's no doubt Ireland is currently a laggard globally in offshore energy

By Mari O'Connor and Frank Crowley, ERI/UCC

We are currently living through a period of intense focus on climate change and the challenges it brings. The potential of the renewable energy sector cannot be overlooked when seeking to address the sustainability issues we face globally. At a European level, the overarching aim of theEuropean Commission's energy policy is to achieve carbon-neutrality by 2050. The energy sector is responsible for more than 75% of the EU’s greenhouse gas emissions which makes increasing the share of renewable energy a critical element of achieving this aim in the future.

As an island nation, Ireland has incredible potential to harness renewable energy sources, particularly wind and wave energy. But our performance to date with respect to overall renewable energy share has not been promising. In 2020, we missed our target of 16% of gross final energy consumption to come from renewable sources. The actual renewable energy share of 13.5% meant Ireland had to acquire transfers of renewable energy from other European member states to compensate for the shortfall.

Ireland's renewable energy share target for 2030 is just over 34%, which indicates a growing need to focus on the renewable energy sector to achieve this. To date, wind energy has been the most significant source of renewable energy in Ireland. The potential of wave energy is huge and it alone could provide up to 75% of Ireland’s electricity requirements. The key issue now is how best to grow the offshore renewable energy sector in Ireland.

New research on the offshore renewable energy sector in Ireland, the UK and Europe as part of the EU SELKIE Project, conducted by researchers in the Cork University Business School at UCC, shows that there are significant strengths within the sector, but there are also many challenges impeding its scalability. Let's start with the positives. Many of the firms are involved in more than one energy sector, with wave, tidal and offshore wind energy the most common. The least common sectors are salient gradient energy and ocean thermal energy. This may indicate the presence of synergies which allow firms to utilise knowledge gained in one sub-sector to be used in another.

The firms are predominantly young, microbusinesses, with a highly educated workforce. Most are involved in the earlier developmental stages including the Research and Development and Demonstration phases of the technology readiness level.

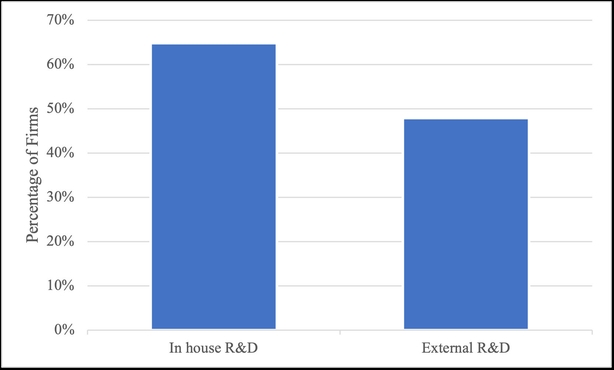

There are high levels of both internal and external research and development activity (see figure 1) conducted by firms, which is an essential first step in the innovation pipeline. This high level of R&D activity by firms in the sector should, in time, translate to improved commercialisation and economic outcomes for the sector, as well as wider benefits to society including an increased share of renewable energy.

Collaboration and networking are important for firms at the earlier stages of the innovation pipeline and directly feed into the research and development of the firm. Both local and international R&D networks were highlighted as very important to increasing the supply of technologies in the sector. This could be attributed to the fact that most companies are functioning at lower levels of technological readiness (proof of concept, validation, and demonstration stage).

Strong industry-university relations are evident, but these are not without their shortcomings. Misaligned incentives between industry and university (publish papers vs. commercial breakthroughs for profit) and rigid academic semesters limit the influence of industry-university collaboration.

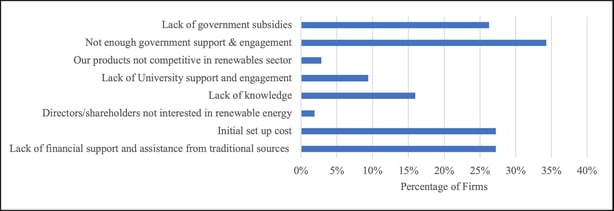

Firms engaged in the sector reported many challenges to entering and growing in the sector (see figure 2). Chief among these is the lack of engagement, support, and financial subsidies from Government. Firms reported a lack of clarity and certainty from Government on the way forward for the sector. They complained about the delays in the finalisation of decisions by government partners, as well as the bureaucracy involved.

As one industry participant noted "the bureaucracy is…very hard, very complicated, to overcome." Interestingly, almost half of firms surveyed said that they agreed with the statement 'that flanking policies are missing to push the expansion of renewables'. This suggests that there is more scope at policy level to support the growth of the sector including a review of the current policy mix, as well as the bureaucratic and decision-making procedures in place.

Other significant barriers encountered included the substantial start-up costs and difficulty accessing finance from traditional sources such as banks. This may reflect the fact that many of the businesses are at the early stages of development and thus may not have established a successful commercial track record in the industry. As a result of this, they may be seen as high-risk investments leading to difficulties accessing the finance they need. As one industry participant noted "private funding is not actually interested because it's too risky".

Despite the significant geographical advantages for offshore energy in Ireland, there is no doubt Ireland is currently a laggard globally in this area. In all, we identified a myriad of challenges for firms in the sector, with many of these challenges stemming from industry-government-university relations.

The question needs to be asked: are we committed to growing this sector in Ireland? If so, there are a lot of problems to overcome. There has been a consensus among various stakeholders for a long time that it is necessary to have certainty around policy and planning frameworks, as well as funding and supporting infrastructure commitments, to stimulate technological investment and commercialisation in the sector. Based on our research, it appears that industry players are still facing uncertainty in all of these areas, which will have a negative impact on investor and entrepreneurial confidence in both the short and long term.

Dr Mari O'Connor is a Researcher at the Spatial and Regional Economics Research Centre and Lecturer of Economics at the Cork University Business School at UCC. Dr Frank Crowley is Co-Director of the Spatial and Regional Economics Research Centre and Lecturer of Economics at the Cork University Business School at UCC and the Environmental Research Institute.