Will 41,000 electric cars be sold in Ireland in 2024? 02 Apr 2024

Analysis: We need to see 41,000 EV sales in 2024 and grow this to 185,000 by 2030 to meet the target of electrifying one-third of cars by 2030 - Dr Tomás Mac Uidhir is a Senior Postdoctoral Researcher in the Energy Policy & Modelling Group at MaREI, the SFI Research Centre for Energy, Climate and Marine at the Environmental Research Institute (ERI) at UCC. Dr Fionn Rogan is a Senior Research Fellow in the MaREI Centre at the ERI in UCC.

Are we at a tipping point for electric vehicle sales? Since 2011, the Irish government has been promoting electric vehicles as a key tool to decarbonise the fleet of roughly 2.3 million cars. While uptake was slow for many years, recent growth suggests a tipping point which could indicate a transition from early adopters (who are more open to novel technologies and some level of risk) to mainstream adopters (who tend to prioritise reliability and cost).

Sales figures are usually reported year on year, comparing the current year compared to the previous year. But to get a sense of possible future trends, it's necessary to look back further than one year. As future analysts have said, you need to look back twice as far as you look forward.

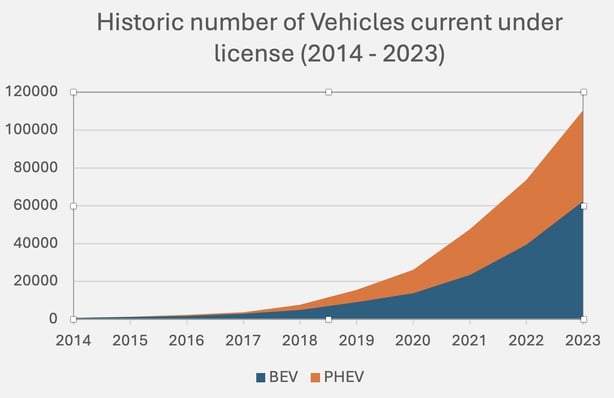

Recent sales data highlights 2021 as a pivotal year in the surge of electric car sales. Between 2014 and 2017, sales of EVs averaged about 0.5% of new car sales. but this increased to 4% (around 4,400 new cars each year) between 2018 and 2020. Between 2020 and 2023, new sales figures have increased by an average of 72% each year with more than three-quarters of all electric vehicles on Irish roads bought since 2021.

The total market share of EVs reached about 19% of new vehicle sales in 2023, and they currently represent 5% of the 2.3 million private cars. The increase in sales and imports is also leading to the development of a growing market for used EVs which will make them more accessible to all road users in the years ahead. This tipping point suggests a major change in the purchasing habits of Irish car buyers as it become a more mainstream idea to go electric.

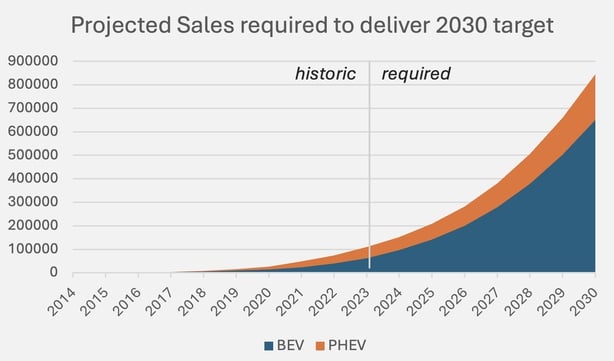

The Irish Government has set targets to reduce emissions across the whole economy. These are expressed as carbon budgets for each sector of the economy, with transport having one of the most challenging targets with an aim to deliver a 50% reduction of total emissions by 2030, relative to 2018. EVs will play a significant role in reaching this target, and the aim is to electrify one-third of the private car fleet by 2030. This represents about 850,000 vehicles and, for context, there are currently about 110,000 EVs on Irish roads.

Even with the recent surge in the growth of electric cars, it can be difficult to capture the scale of sustained change that will be required to meet government targets. Using the LEAP Ireland model, UCC analysis considers the annual sales that will be required to deliver the overall targets and tracks annual progress in real-time using SIMI statistics and data provided from the Department of Transport to understand if we are on track or not.

To stay on track and deliver 2030 EV targets, we need to see about 41,000 EV sales in 2024 and grow that figure to 185,000 by 2030. This figure is equivalent to the total sales of vehicles in 2007 (before the economic downturn and cliff-edge that came with overall sales).

Exponential growth can have an incredible impact on a market, but can be equally hard to predict. Previously (in 2020), UCC analysis used the historical trend of EV sales in Norway (then and now a country with the largest national fleet of EVs) to estimate, that if Ireland was on a Norway trajectory, we would reach 200,000 EVs by 2030.

But Ireland is exceeding that trajectory now. When a new technology takes hold in a market it can be disruptive, replacing the existing technology and changing the landscape of sales patterns and consumer behaviour.

So what has been driving the change? Is it government grants, the ever-increasing cost of petrol and diesel, changes in the underlying technology, consumer preference or a more environmental conscious driver-base? It is likely a combination of all these factors, but a recent survey from DoneDeal indicated that 90% of EV drivers realised lower running costs in 2023, and 70% will continue to buy EVs going forward. However, range anxiety and concerns abouyt charging infrastructure remain a worry for EV owners who made the switch.

EVs offer many advantages over their Internal Combustion Engine (ICE) counterparts: they are cheaper to run, are more energy efficient, have zero tailpipe emissions and they produce no harmful gases (NOX, SOX, PM2.5). From an emissions perspective, it makes a big difference if the vehicles drive train is fully electric, i.e., a Battery Electric Vehicle (BEV), or a Plug-in Hybrid Electric Vehicle (PHEV).

BEVs are currently dominating new car sales within the EV market, with BEVs occupying 70% of EV sales in 2023. Even if Ireland sees 850,000 EVs on the road by 2030, a lot more policy measures (such as biofuel blending, increased public transport, more walking and cycling and less KMs travelled in traditional petrol and diesel cars) will still be required to meet the transport sector's GHG emissions reduction targets.

Electric vehicles also raise some economic and social challenges. As EV adoption increases, the sustainability of the current motor tax regime and grants for EVs will become more pressing. Currently, most EV sales are for new cars, with the used EV market still quite small, which prompts concerns over equitable access across all demographics. Whether we have already crossed the tipping point or stand on its edge, the push towards electrification is undeniable. 2024 will be telling: will the benchmark of 41,000 sales be met, and will the trend towards electric vehicles influence your next car purchase?